Berlin Hyp

Commercial real estate lending is a demanding and detail-intensive field. Banks such as Berlin Hyp AG must coordinate many stakeholders, manage large volumes of data, and meet strict regulatory standards. Guided by the principles of Workflow Intelligence, sclable and Berlin Hyp combined human expertise with intelligent automation to streamline decision-making and lay the foundation for continuous improvement.

“Not only did sclable digitize our lending process, but it supported the team as we reorganized operations to suit new structured ways of working. Now, in addition to our employees easily getting the ‘big picture’ of each loan, the process and data is streamlined and opens up new potential for future improvements.“

Head of Core Process Strategy, Berlin Hyp AG

Our Partnership

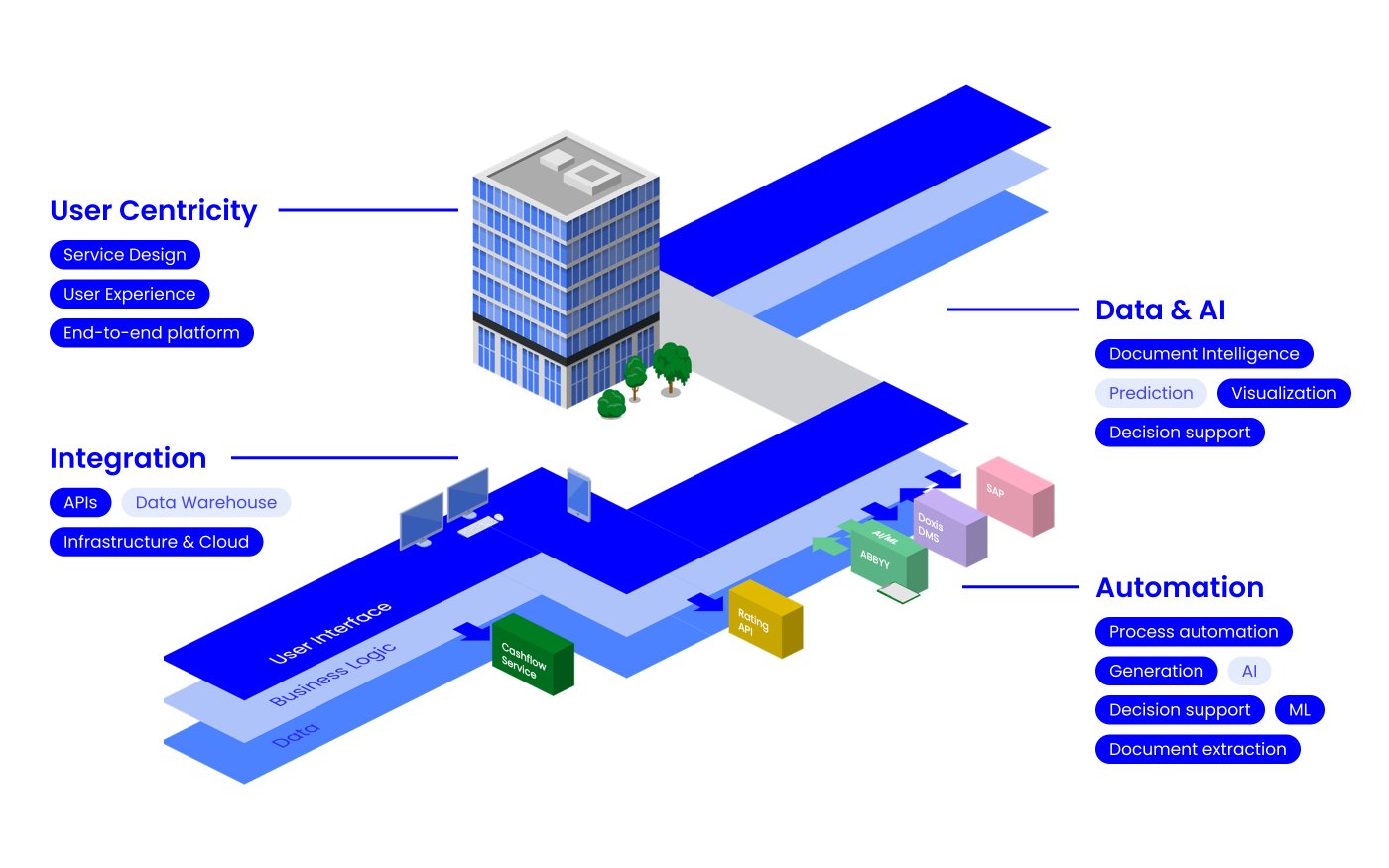

Together, we built the technological backbone for a modern lending platform that unites process transparency, data consistency, and automation. The result is a solution that simplifies daily work and strengthens Berlin Hyp’s leadership in commercial real estate finance.

The Challenge

Berlin Hyp needed to improve efficiency, manage increasing data volumes, and create greater transparency across departments and systems.

The challenges included:

- Data scattered across multiple systems.

- Heavy manual effort for digitizing and validating information.

- Limited visibility across teams.

- Inconsistent calculation logic and redundant workflows.

Staying competitive required a move from manual coordination to a fully digital and connected lending process.

Our Solution

In collaboration with Roland Berger, sclable reimagined Berlin Hyp’s loan process from application to approval and monitoring.

The result is a user-focused, task-based portal that centralizes data, automates workflows, and integrates seamlessly into the bank’s IT infrastructure.

The solution at a glance:

- Human-centered: Designed around real work practices, enabling intuitive access and collaboration across departments.

- Technology-driven: Automated document extraction, AI validation, and integration with over ten systems ensure accuracy, speed, and transparency.

- System-wide: Built on Workflow Intelligence, the solution connects data, people, and processes, creating consistent calculations and a transparent loan overview.

The portal enables teams to continue their work as usual while benefiting from automated processes, higher data quality, and real-time collaboration.

Why it matters

Berlin Hyp plays a vital role in financing and shaping the commercial real estate market. By embracing digital transformation early, the bank created a lending platform that supports operational excellence and future growth.

The result is faster, more transparent, and more reliable lending processes that enhance both internal efficiency and customer experience—reinforcing Berlin Hyp’s position as an industry leader.

What we achieved together

Enhanced data quality

Automation improves data accuracy and delivery speed.

Interdepartmental alignment

Centralized, accessible data connects all departments.

Aligned calculation and business logic

Consistent, transparent information across the organization.

Automation and integration

Data from over ten systems unified into one solution.